Framed or unframed, desk size to sofa size, printed by us in Arizona and Alabama since 2007. Explore now.

Shorpy is funded by you. Patreon contributors get an ad-free experience.

Learn more.

- Tough Guys

- Lost in Toyland

- And without gloves

- If I were a blindfolded time traveler

- Smoke Consumer Also Cooks

- Oh that stove!

- Possibly still there?

- What?!?

- $100 Reward

- Freeze Frame

- Texas Flyer wanted

- Just a Year Too Soon

- WWII -- Replacing men with women at the railroad crossing.

- Yes, Icing

- You kids drive me nuts!

- NOT An Easy Job

- I wonder

- Just add window boxes

- Icing Platform?

- Indiana Harbor Belt abides

- Freezing haze

- Corrections (for those who care)

- C&NW at Nelson

- Fallen Flags

- A dangerous job made worse

- Water Stop

- Passenger trains have right of way over freights?

- Coal

- Never ceases to amaze me.

- Still chuggin' (in model form)

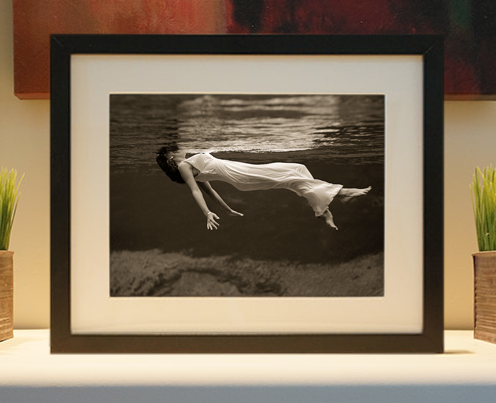

Print Emporium

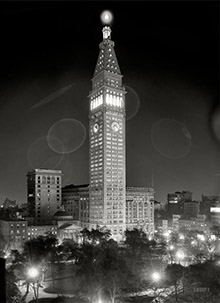

The Tax Clock: 1939

January 18, 1939. Washington, D.C. "'Less taxes, more jobs' reads the poster being pasted up by George H. Davis. It is the first of 25,000 such signs which will be put up all over the nation as part of a drive for reduction in taxes by the U.S. Chamber of Commerce. President Davis called in the photographers today to see the first one done right." Harris & Ewing Collection glass negative. View full size.

Re:Re: Opposing view

The following link is to the historic tax tables from the present back through 1913.

http://www.taxfoundation.org/publications/show/151.html

Yes, the top tier was only on huge amounts in 1939, but during and after the war they went up across the board - the previous example from 1953 showed that at only $16,000, the feds took over half your income.

[Commenter Samham replies: "You are misinterpreting marginal rates. The tax applies only to the amounts in the specific bracket, not total income. In the case of a single payer in 1953, the 53 percent rate applied only income between $14,000 and $16,000."]

Less, Fewer, Lower Taxes

Fewer Taxes means a reduction in the number or types of taxes being levied. No confusion there. But the use of Less with a plural noun like Taxes is a confusion between uncountable and countable nouns, and, even though used by many, sounds barbaric at best to them what don't. "Taxes" is not an uncountable noun. Uncountable nouns describe substances like sand, water or mustard (none of which are made plural when used with Less). So, there may be less water and less sand, and I'd like less mustard on that next hot dog, please. But the plural noun Taxes describes a set of similar, countable things, which do not somehow become a substance when lumped together. Each item in the set is called a Tax, which is a monetary levy with a defined percentage rate. The Sales Tax is set at eight percent in some places, and some people once paid as much as ninety percent on their Income Tax. And many people (and Chambers of Commerce) would like to see these Taxes (that is, the Tax Rates) become LOWER, not LESS.

[So who wants to colorize this? - Dave]

Re: Opposing View

My understanding of the tax codes of the past is that those high rates (in the 90% range, etc) back during World War 2 and beyond were only for any income ABOVE $200,000--that's pretty good money for the 40's and the 50's. Later it was on income over $400,000, and before that--in the 1930's--the highest rates were for income over $5,000,000. 5 million dollars! In the middle of the depression! Those who were making that kind of money back then have nothing to complain about, and we shouldn't weep for them now.

It was highly responsible of the government to raise taxes during World Wars 1 and 2 in order to pay for them. Thank god they did.

It worked, sort of

Mr. Davis didn't get everything he wanted from Washington that year, but he got enough to turn a corner. An alliance between the Chamber, Henry Morgenthau's Department of the Treasury, and Sen. Pat Harrison, conservative chair of the Senate Finance Committee, prevailed over the remaining New Dealers, in blocking further tax hikes and opening up new loopholes. Roosevelt went along, expecting the gratitude of business, but was disappointed when the Chamber simply demanded more tax breaks the next year, while backing Willkie.

Income Redistribution

Right now the national debt is a little over $11 trillion. What retires the debt is taxes -- and there is no way to not retire the debt unless this country starts defaulting on its obligations to creditors, i.e. stops redeeming Treasury notes.

The national debt isn't going down because the federal budget runs at a deficit every year. The usual reaction to this is to blame Congress and "politicians." But politicians are not aliens from Mars, they're us, and do whatever it takes to get reelected. Which is shovel out the entitlements.

The Big 3 entitlements -- Social Security, Medicare and Medicaid -- account for the majority of federal spending every year -- two-thirds of the federal budget. There is no way to substantially reduce taxes without decreasing payments to retirees. (And even if entitlement spending were cut off completely, and deficit spending came to an end, there's still that $11 trillion in outstanding debt that has to be paid off.)

It's withholding from the paychecks of today's working-age people that go to pay today's retirees. It can't go on forever.

The opposing view

In 1939 the top tax rate was 79%; and it only went up from there. Once the war hit, the rates skyrocketed, and remained at over 90% until it dropped back to 77% in 1964. In 1953, if you made $16,000, after only the Federal tax you brought home $7040, and if your income was $100,000, you only brought home $10,000. To see how it would stifle business, ask yourself...is it really worth it to put in the enormous effort it would take to increase your income from $16,000 to $100,000 if all you got for your trouble was $2960?

Yes, it was in his best interest to lower his taxes, but most businessmen try to grow their business. Higher taxes mean less money to invest, which means less growth, which means fewer jobs available for those who don't run their own business, but rely on others for their employment.

It may seem like a great idea to tax the rich businessman out of his shirt, but it only dries up the job market in the end (and be sure of it, the owner probably still made his).

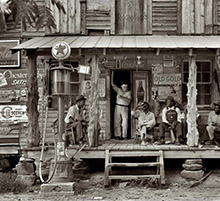

Workers' Paradise

You can be reasonably certain that standing just off camera are a couple of guys in overalls and glue soaked hands watching Mr. Davis mime the job that they just did. And, once Mr. Davis gets back into his limo, they'll be putting up the remainder of those 25,000 signs.

Of course it was all for our benefit.

Business didn't really WANT the tax breaks, they were just trying to help the little guy out the only way they knew how.

New Deal = Socialism

Everything old is new again! I have a hunch if Mr. George H. Davis were alive today he would be a frequent guest on Bill O'Reilly's and Sean Hannity's shows.

Somehow, we were miraculously spared the inevitable fate proclaimed by Mr. Davis that the New Deal would move us "straight down the road by which 'business will logically be required to disappear.'" Does this remind anyone else of the hyperbolic scare-tactics in the current debate over health-care reform?

Washington Post, Feb 21, 1939Government Meddling

Perplexing Headlines

By Mark Sullivan

On the first page of the New York Times the other day, in adjoining columns, was one of those curious juxtapositions of headlines which add interest to public events, and sometimes throw light on them. One headline was over remarks by President Roosevelt in a press conference while on his way to his vacation. This headline said:

"Roosevelt Tells Business ... Confidence Is in Order. An Assuring Tone. No Cause for Misgiving." In his talk, Mr. Roosevelt was described as saying that "Business and industry ... could look forward without any misgivings as to the Administration's objectives in the months ahead."

The other headline was over an address by the president of the Chamber of Commerce of the United States, Mr. George H. Davis. In part this headline said: "G.H. Davis Warns New Deal Moves Country Towards the Socialist State." In his talk Mr. Davis said that "Washington is moving surely into the State Capitalism that marks the totalitarian countries of Europe ... Thus we move straight down the road by which 'business will logically be required to disappear.'"

...

Less Taxes is A-OK!

If you are making a comparison in quantity that can be counted individually, the choice is FEWER: "Fewer apples."

If the quantity is continuous (like water) or entails a number too large to count, the choice is LESS: "Less sand on the beach."

"Fewer taxes" is a reduction of individual tax categories (sales, income, etc.) "Less taxes" is a reduction in money owed.

The Tax Man

I like the fact that Mr. Davis was straightforward about the fact that this was nothing other than a photo op. Despite his claims about "getting it right," it looks like there are more than a few bubbles in the billboard. He's got a mean brush, though.

Mucher Grammar Wanted

Less Taxes? On 25,000 signs? Shouldn't that have been Fewer Taxes or Lower Taxes? Or was this lobbying campaign consciously written so it could be understood by the barely literate Little Man?

Credible

Well, if an old white guy supports it, you KNOW it's good for everyone.

Imagine!

In 1939, you put on a coat and tie to glue up a billboard!

What Helps Business Helps You

What's good for General Motors is good for the country.

On Shorpy:

Today’s Top 5