Framed or unframed, desk size to sofa size, printed by us in Arizona and Alabama since 2007. Explore now.

Shorpy is funded by you. Patreon contributors get an ad-free experience.

Learn more.

- Freeze Frame

- Texas Flyer wanted

- Just a Year Too Soon

- WWII -- Replacing men with women at the railroad crossing.

- Yes, Icing

- You kids drive me nuts!

- NOT An Easy Job

- I wonder

- Just add window boxes

- Icing Platform?

- Indiana Harbor Belt abides

- Freezing haze

- Corrections (for those who care)

- C&NW at Nelson

- Fallen Flags

- A dangerous job made worse

- Water Stop

- Passenger trains have right of way over freights?

- Coal

- Never ceases to amaze me.

- Still chuggin' (in model form)

- Great shot

- Westerly Breeze

- For the men, a trapeze

- Tickled

- Sense of loneliness ...

- 2 cents

- Charm City

- What an Outrage

- Brighton Park

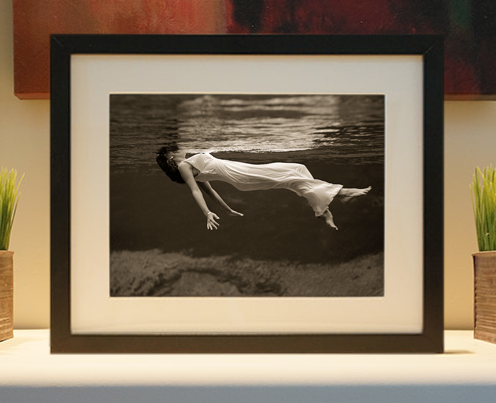

Print Emporium

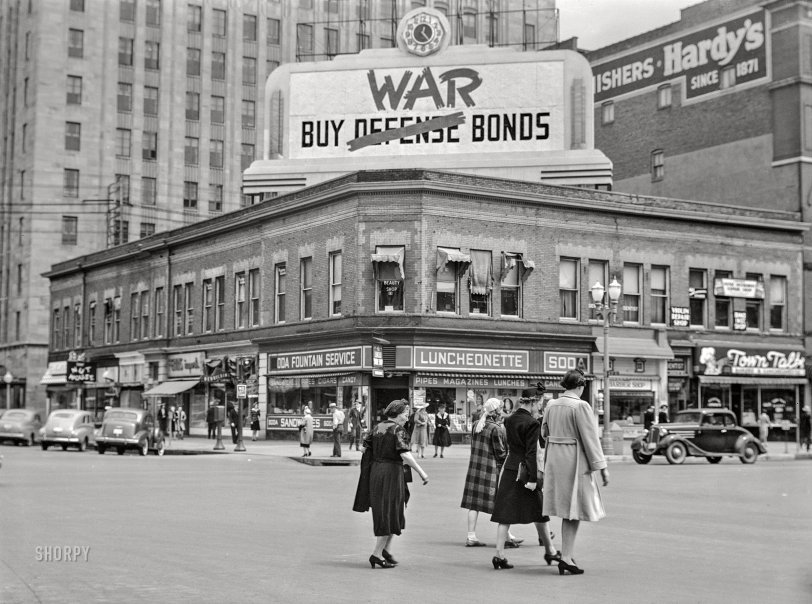

Buy War Bonds: 1942

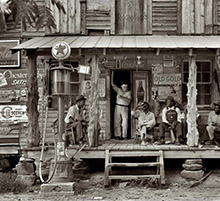

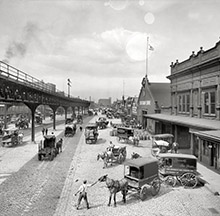

May 1942. "Street corner in downtown Lincoln during University of Nebraska commencement week." Medium format acetate negative by John Vachon. View full size.

Stuart Theatre

Yes, this is looking at the northeast corner of 13th and "O" Streets. I used to walk by here all the time when I lived in Lincoln in the 1980s.

The tall building in the background was built in 1929 and contained the exuberant Stuart Theatre. The theater was poorly renovated in the 1970s to cover up much of the original decor. It was still a great place to watch a movie, however. A couple of decades and a few owners later the theater was returned to its over-the-top interior and is now called the Rococo.

To the left, on the west side of 13th Street, now sits a bank building designed by I.M. Pei that is shaped like an outline of the state of Nebraska. It was the first place I used an ATM!

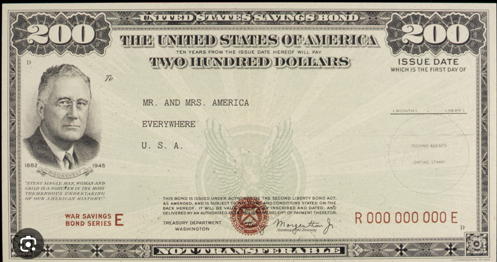

About war bonds

US Savings Bonds were first authorized in 1935. In April 1941, Series E were issued as Defense Bonds. As the billboard dramatically shows, they became War Bonds right after Pearl Harbor.

Just as the goal of gasoline rationing was to save rubber, a major purpose of war bonds was to reduce inflation by taking money out of circulation during a time of full employment and rationing.

War bonds paid a mere 2.9% interest after 10-year maturity.

Only about one percent of matured savings bonds have not been redeemed, but that amounts to around $9 billion.

We haven't stopped having wars since 1945, but the term "war bond" has never been used again.

The Nut House is no more

Here is a photo with which to make a better comparison of the tall building behind the Buy War Bonds sign and the Street view below. If I'm correct we're at the intersection of 13th and O streets, looking north. The brick two-story structure on the corner has been replaced by a modern five-story and the Nut House did not survive the transition. Nuts!

On Shorpy:

Today’s Top 5